Let’s be frank, the demographical data we hold about our readers suggests that if you are reading this now then you are pretty damned lucky.

Yes, it may be raining where you are, I’m pretty sure your girlfriend is cheating on you and your favourite sports team probably just lost again (Go local sports team!). But, if you are reading this then you are lucky enough to be fluent in the language of international business, you probably hold a relatively powerful passport, and presumably, have enough money to think about doing a spot of travelling sometime in the near future. All of that very much places you amongst the winning ticket holders in life’s giant lottery.

So considering the lucky little leprechaun you are, you may well be wondering whether you need travel insurance. After all, insurance is something that only unlucky people ever need. Furthermore, as we learned during the last few years of the COVID pandemic, travel insurers have a habit of not even paying out on claims anywhere when the going gets real tough.

With all of that in mind, we are today going to look at whether you need travel insurance, what kind of travel insurance you might need, and how much travel insurance you need (if any).

In a Hurry? Should You Get Insurance?

World Nomads’ mission is to support and encourage travellers to explore their boundaries. They offer simple & flexible travel insurance, and safety advice to help you travel confidently.

They’ve been doing it since 2002 – protecting, connecting, and inspiring independent travellers just like you.

Get a quote below or read our in-depth review!

World Nomads provides travel insurance for travelers in over 100 countries. As an affiliate, we receive a fee when you get a quote from World Nomads using this link. We do not represent World Nomads. This is information only and not a recommendation to buy travel insurance.

Why You (Yes You) Might Need Travel Insurance

In this post, we are going to examine what travel insurance is, what it can cover and who might benefit from it. We will look at where it might be useful to have travel insurance, what to look for when choosing it, and how much it costs. We will also look at who does not need travel insurance.

We will, however, start by addressing that giant elephant in the room that is COVID-19. (Arrgghhh. Boo! Hiss!!)

COVID and Travel Insurance

When COVID-19 first rocked the world in 2020, most travel insurers were quick to invoke their cancellation clauses and pull all cover relating to either illness, cancellation or disruption caused by the pesky pandemic.

These days, most insurance providers are offering some form of COVID coverage included within their policies, but some are more useful than others. Whilst many now cover hospitalisation caused by COVID infections, fewer are offering any kind of cover for disruption or cancellation such as being refused boarding on a flight for displaying symptoms or having to cancel your trip because of a positive test.

Whilst the pandemic has largely subsided, COVID is still able to severely disrupt travel plans. Therefore do consider paying close attention to the finer details of any insurers’ COVID-19 cover.

We are aware of two reputable travel issuers who may be of interest here. Both World Nomads and SafetyWing can offer COVID-19 coverage in their policies and may be able to cover you for illness, evacuation cancellation and interruption.

Is It Even Time To Travel?

The last few years haven’t been particularly prosperous for the travel industry. In fact, you might even say that the COVID pandemic has been on the epically, disastrously, catastrophic side for the business as border closures, long lockdowns and the collapse of consumer confidence all conspired to drive many airlines, hostels and travel agencies to the point of bankruptcy and beyond.

As we enter Spring 2022, things are however looking up. The UK has announced an effective end to the pandemic, Australia has finally re-opened its borders (NOT to refugees or certain Tennis players’ mind) and Southeast Asia looks set to begin re-admitting tourists albeit under its pilot, “sandbox” programme. Whilst a few outliers such as Canada and France seem determined to hang onto the pandemic a bit longer and maybe even squeeze a little civil war out of it, the world at large seems ready to get moving again.

Therefore it may (whisper it) just about be time to start looking ahead to summer vacations. COVID has not gone away but then again, it is not going to go away. Malaria, Rabies and TB never went away and are actually semi-common in the developing world.

So if you ask us, it is absolutely 100% time to get your ass back in the saddle and hit the road. And honestly, there are plenty of places on earth where the local economies are absolutely desperate for you to start travelling again.

But one question that many travellers will be asking is, do I need travel insurance and why do I need insurance? Cos the travel insurers are also desperate for you to start travelling again too…

Who Does NOT Need Travel Insurance?

Ok so legitimately, there are a few scenarios where travel insurance might not be all that helpful to you. To offer up one example, if you are an EU citizen travelling to another EU country then you are fully entitled to health care as long as you have your EHIC card (and possibly even if you don’t).

Therefore you don’t need to worry about getting travel insurance to cover your medical costs. Whilst travel insurance may still be helpful to protect against things like flight cancellations and lost luggage, it’s a matter of doing the maths and working out whether it’s cost-effective; personally, I would not bother to insure a €50 Ryanair, carry-on only, stay in a hostel-type trip.

Other than that and a few other niche examples, let’s look at who else probably does not need travel insurance.

- The Insanely Rich – If you are rich enough to not care about losing a $4k holiday or racking up a $50k medical bill, then you don’t need to worry too much about getting travel insurance. Sure, whilst $50k is still 1000 times the cost of a $50 travel insurance policy, it’s all ultimately just pocket change isn’t it? But of course, in reality the rich are some of the biggest bean counters going so rest assured, even Jeff ‘Pee in a Bottle Ya Bastards’ Bezos probably travels with insurance when he flies to space in his private, phallic shaped rocket.

- The Ridiculously Lucky – There is lucky and then there is lucky. So are you the kind of person who wins the lottery without even entering? Or perhaps you once fell out of a plane and landed on a trampoline? If this is you then don’t waste your money on insurance – even if you are late for your flight the pilot will wait for you and if your bag is lost, you’ll probably just pick up somebody else’s filled with designer clothes that fit you perfectly.

- Smart People – Only stupid people ever need to make insurance claims. Smart people don’t get malaria (the biggest killer in history) as they can outfox mosquitos and they are far too cunning to get jacked by professional criminals. (Sarcasm guys!!)

- Keith Richards – As well as being insanely rich, ridiculously lucky and pretty smart, Keith Richards is also immortal. Therefore, if you are Keith Richards then you really do not need to get travel insurance and do not need to read any further – after all those coconut trees won’t climb themselves now.

Now that that is out of the way, let’s resume our attempts at being moderately sensible. In the next section, we shall examine what exactly travel insurance can help with. Or, you can just hit the button below to get a quote from either of our two preferred travel insurers provided.

Why Do I Need Travel Insurance?

Let’s look at some of the things that travel insurance can cover. This list is not intended to be exhaustive or intimately detailed but rather, is here to offer a flavour.

Sickness and Medical Costs – Visiting a Doctor or getting hospitalised abroad can prove crushingly expensive. During our 10 years of living dangerously, team Broke Backpacker have endured bike crashes, tropical diseases and so much more. The problem here is that if you need medical assistance, you need it and will have to pay whatever they tell you and will not be in a position to barter or shop around.

Every year, thousands of travellers have accidents or get sick when travelling. Some countries have free (UK) or low price (India) healthcare but others (Japan, the US) have disgracefully expensive healthcare systems.

Lost Luggage – Every year, airlines lose hundreds of thousands of bags. They shouldn’t, but they do. Some eventually turn up but others don’t. If you arrive on your travels and have no clothes to wear, then that sucks (unless you’re at a nudist beach!), but having to re-wardrobe out of your own pocket may mean burning through your travel budget on the very first day.

We’ve tested countlessday packs over the years, but the Tropicfeel Shell is something else. There are a lot of flashy backpacks on the market but not many come with a detachable wardrobe.

Weatherproof, eco-friendly, durable, feature-loaded, and comfy as fudge brownies: these are just some of the words people might use to describe the Tropicfeel Shell. But we just call it bloody beautiful.

Learn More • View on TropicfeelTheft or Loss – Sadly, tourists are a target for criminals. Whether it is a violent street mugging in Mexico or a raided hotel room raid in Marbella, electronics, jewellery and passports are stolen from travellers far too frequently.

Trip Cancellation – If something happens and you are not able to take your trip, then trip cancellation may reimburse you the cost of the flight, accommodation or whatever. The cancellation has to occur for a “legitimate” reason such as war or sickness and not just because you changed your mind.

Trip Interruption – This is when something goes wrong on your trip and you are forced to hastily re-arrange at your own cost. Examples may include your hotel burning down and so you are forced to pay out for a second one, or a missed connection flight.

Personal Liability – This is when your error or negligence causes somebody else’s loss. Let’s say you sneeze and the Taj Mahal collapses as a consequence leaving you with the $500 repair bill – personal liability insurance may indemnify you here.

Evacuation and Repatriation – This aspect of travel insurance cover can help when you need to evacuate a particular location or flee a country. If you break your leg on a mountain and need a helicopter, then travel insurance may cover the hefty cost of the heli-evac. Or, if a natural disaster strikes and you are forced to leave the country on an emergency flight, then the repatriation clause may cover this.

Death – Granted, dead people are not really in a position to make insurance claims. However, dying abroad is seriously expensive and so travel insurance can help with the hefty cost of sending a traveller’s body home – the alternative is that the grieving family is left with the bill. Not fun.

Is Travel Insurance Mandatory?

Usually, travel insurance is not mandatory although it is almost always advisory.

However, there are currently 60 countries where you may actually be obligated to obtain travel insurance. This means that you may be asked to provide proof of cover before you are even allowed to enter or maybe even before you can even board a flight.

Usually, though, there are different rules for different nationalities so whether or not you need to buy insurance for your destination might depend on what passport you hold. This is not simply a case of wanton favouritism and discrimination, but rather reflects the various arrangements that countries have between themselves.

For example, whilst some EU countries require visitors to obtain insurance before entering, this requirement does not apply to passport holders from other EU countries as they are all members of the EHIC scheme. You may also be interested to learn that to date, I have never been asked to provide evidence of insurance when entering the EU even with a post-Brexit British passport although that may eventually change.

Finally, some countries that mandate insurance (Belize for example), make you buy insurance from them, upon arrival. Whether or not you already have cover is irrelevant here, you will still be obligated to buy the mandatory policy. Note that usually, the policy is purely for medical costs and nothing else. Therefore in cases like this, you may still wish to purchase your own cover before leaving home; and ultimately, it is better to be overinsured than underinsured.

Some countries also currently have rules in force specifically relating to COVID-19 and may require you to obtain COVID cover before they let you enter. This is because they don’t want to have to bear the cost of your quarantine or isolation if you test positive let alone any treatment you may need. The situation here is a very fluid one and we suggest you check the current state of play at your destination regularly.

What Travel Insurance Do I Need?

If you are still reading then I guess you have decided that you probably do need to get travel insurance. Smart move. So the next question to ask is exactly what travel insurance do you need?

A lot of travel insurers really specialise in covering “Square John” trips such as 2-week, set vacations to safe, family-friendly, resort-type destinations. These kinds of policies are fine a lot of the time but if you read the small print you may find that they are not suitable for backpackers or adventure tourists.

For example, if you are going trekking, then you need to ensure your insurance covers trekking and that it also covers the exact altitude you will be trekking at.

If you are going backpacking, or on any kind of adventure trip then it may be wise to avoid straight-laced insurers and instead go straight to the backpacker insurance specialists like World Nomad. Yes, they are more expensive but you are paying for the expertise and paying to make sure your exact trip is actually properly covered.

Additionally, if you travel with any expensive or specialist gear (be it a laptop, camera or skis) then you may need to insure it separately. You might also want to look at the travel insurance companies for staying in a hostel if that will be your primary accommodation type too.

How Much Travel Insurance Do I Need?

Whatever policy you go for will probably include all of the protection we set out in the previous section headed “Why Do I Need Travel Insurance?” (there are a few exceptions that we shall explore later). Some policies also include little extras such as rental car cover but the above is a good starting point. Therefore the next thing we are going to focus on is the amounts covered and the policy excess’.

Medical costs can by far prove to be the most costly expense when making a claim as bad accidents or long hospital stays can cost tens of thousands of bucks or more. Most policies we have seen offer medical cover ranging from $500k – $1 million.

Lost luggage on the other hand tends to be capped at $1000 – $1500 with a single item limit of $500. Whilst this is barely half the cost of a laptop, it is unfortunately pretty standard in the travel insurance sector. If you travel with valuable gear that you cannot afford to lose, then perhaps consider taking a separate, dedicated gadget cover.

Trip cancellation and interruption is often also limited to a few $k so if you are booking a once in a lifetime cruise worth $10k, then pay attention and make sure the cancellation cover is sufficient. Alternatively, if you find a customisable policy then you can tailor it to meet your needs – although this will increase the cover cost substantially.

A policy excess is an amount that you have to pay out of your own pocket before you can claim on the insurance policy. For example, I recently had to get a bunch of tetanus and rabies shots in India (Meeow indeed) which cost me a total of $40. As the excess on my policy is $50, I was NOT able to claim this back from my insurance. This sucks but once again, it is pretty much an industry standard.

Basically, it is not for us to tell you how much cover you need but the figures we have offered above should give you a rough figure of what you can expect to find.

How To Find Travel Insurance

We live in an age of market comparison sites and if you google “how to find travel insurance” you will be greeted with a plethora of comparison engines all promising to help you find the best, cheapest and perfect travel insurance for your trip. For example, you can get specific European travel insurance which is cheaper than say a policy covering the USA as well.

But, (and it’s a big, fat, stinking, hairy butt) using comparison sites to find travel insurance can actually be pretty foolhardy. I shall explain why.

Firstly, not all insurance companies appear in all engines. Market comparison sites only feature companies who are willing to grant them a backhander for successful referrals and if a company is not willing to engage in this wanton bribery, they will simply not appear in the search.

To really illustrate this, let us tell you now that both of the companies we personally use for our trips are absent from the most popular market aggregator engines.

Furthermore, if you actually get into the details and look into the small print you will sometimes find that the suggested companies can’t actually cover your trip.

For example, I recently used a few market comparison sites to try and insure my trip to India and out of the 5 top choices, 3 of the companies were not even covering India at the time owing to COVID issues. I only noticed this after going through the small print myself.

In summary, whilst market comparison sites can be a useful tool, do remember that there are other tools in the shed.

Who Is The Best Travel Insurer?

There is no such thing as ‘the best’ travel insurance provider just as there is no such thing as ‘the best’ colour. Rather, all have different strengths and weaknesses and all have a place in the spectrum.

However, over many years of travelling and quite a few insurance claims made along the way, we have identified a few who we prefer and who we now use to cover most of our trips. If you like, you can check out our long in-depth post about all the best travel insurance companies. you can just check out our absolute top 2 tops below.

Let’s meet them!

World Nomads

World Nomads have been protecting, connecting, and inspiring independent travellers since 2002. They offer simple and flexible travel insurance, covering more than 150 activities as well as emergencies, lost luggages, trip cancellations, and more.

Get a quote below or read our in-depth review!

Heymondo

Talk about efficient and effective, Heymondo are up-to-date when it comes to combining travel insurance with technology in the digital world of 2022. What truly sets them apart is their assistance app offering a 24-hour medical chat, free emergency assistance calls and incident management. They also have a convenient and complication-free way to make a claim straight from your phone.

Medical expenses are covered up to $10,000,000 USD so try not to damage yourself anything over that amount… If you’d like travel insurance that operates with that little extra swiftness and ease, give these guys a go. They offer multiple options – single trip, annual multi-trip and long stay. We’ve focused on single trip, but do check out the others and find what fits your next adventure.

If you need more convincing, The Broke Backpacker readers get 5% off their Heymondo travel insurance plan. Plus, you can get this insurance after departure!

SafetyWing

SafetyWing is a relatively young start-up that is fast positioning itself as the premier insurance provider for digital nomads and long term travellers.

SafetyWing doesn’t offer your typical travel insurance and their policies actually lack a lot of the common features such as trip cancellation and lost luggage. Instead, they specialise in offering rolling, well and simply priced health insurance which you can buy on a monthly subscription basis.

What we particularly love about Safety Wing is that they can help with dental health care and even offer some cover for travellers visiting their home countries.

For more info, why not check out our detailed SafetyWing insurance review or else just click the button below to go to the site.

Need help deciding between Safety Wing or Hey Mondo? Check out our helpful guide.

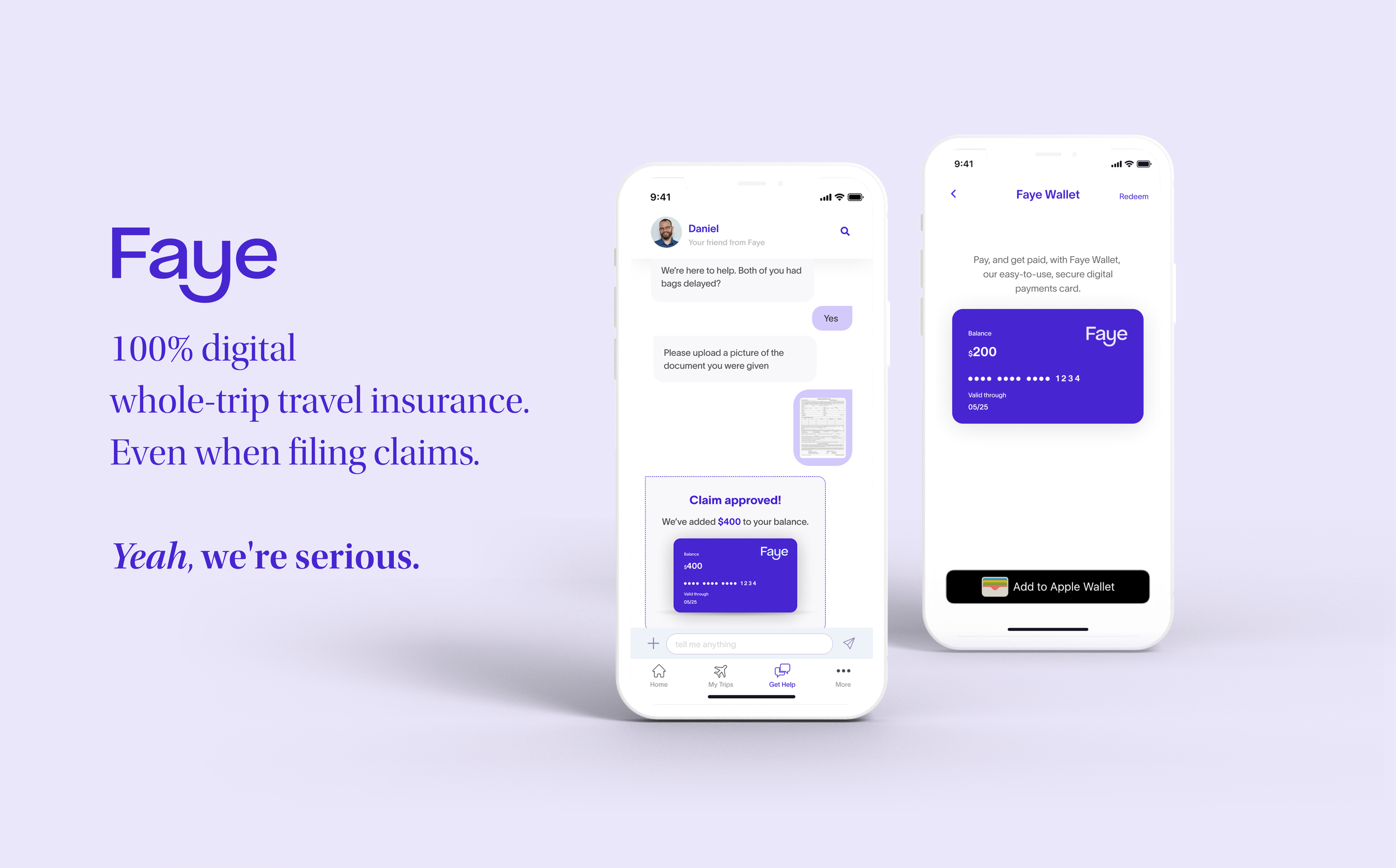

Faye

Faye provides whole-trip travel coverage and care that brings out the best in each journey with industry-leading technology that enables smarter and smoother assistance with faster claims resolutions. Their app based travel insurance covers your health, your trip and your gear all via an app that provides real-time proactive solutions, quick reimbursements and 24/7 customer support.

If you ever do need to make a claim, then you simply log in to the app and the claim will be assessed super quickly from anywhere in the world!

Best of all, if the claim is successful then the funds will be immediately credited to the smart wallet on your phone or device and ready for you to spend.

In summary, we have tried and tested a lot of different insurance policies and we have never found anything one like this. The only downside we have found so far is that they can only offer cover to residents of 43 US States although there are plans to go nationwide in the future. You can read the full Faye travel insurance review if you need more info.

There’s also a review of Allianz Travel Insurance if you’re like a Bayern Munich fan or something!

Staying Safe on The Road

In our humble opinion, it is very important to get travel insurance before leaving home. But, prevention is always better than a cure and the best course of action is to take absolute care out there, and hopefully, you will never actually need to make a travel insurance claim.

Whilst you want to have fun when travelling, please act sensibly and don’t indulge in any stupid behaviour that would get you into serious trouble back home. I mean, whilst you may well get away with riding a scooter blind drunk in Thailand, that does not mean you should do it.

Likewise, don’t wear expensive jewellery or wantonly flash electronic items in poor countries as this will make you a shiny beacon for thieves. Basically, just use “common sense” and if you don’t have any common sense (it’s actually far less common than the moniker would have you believe) then go and check out our pretty extensive library of safety themed content.

Finally, wear a money belt and think about seeing a doctor or travel nurse 12 weeks before your departure to check whether your travel vaccinations are in order. Anyway, lecture over!

Get your cash stashed with this awesome Pacsafe money belt. It will keep your valuables safe no matter where you go.

It looks exactly like a normal belt except for a SECRET interior pocket perfectly designed to hide a wad of cash or a passport copy. Never get caught with your pants down again! (Unless you want to.)

Hide Yo’ Money!Final Thoughts on Travel Insurance

By now you will hopefully have decided for yourself whether or not you need travel insurance. Personally, I think it is very important for most trips but you need to decide for yourself.

If you think you will be OK without it then we wish you the best of luck. If on the other hand, you do want to get your ass covered, then you hopefully have all of the info you need to find the right policy from the right provider to suit your needs.

Take care out there.

And for transparency’s sake, please know that some of the links in our content are affiliate links. That means that if you book your accommodation, buy your gear, or sort your insurance through our link, we earn a small commission (at no extra cost to you). That said, we only link to the gear we trust and never recommend services we don’t believe are up to scratch. Again, thank you!